Second quarter 2020 (2Q20) financial highlights

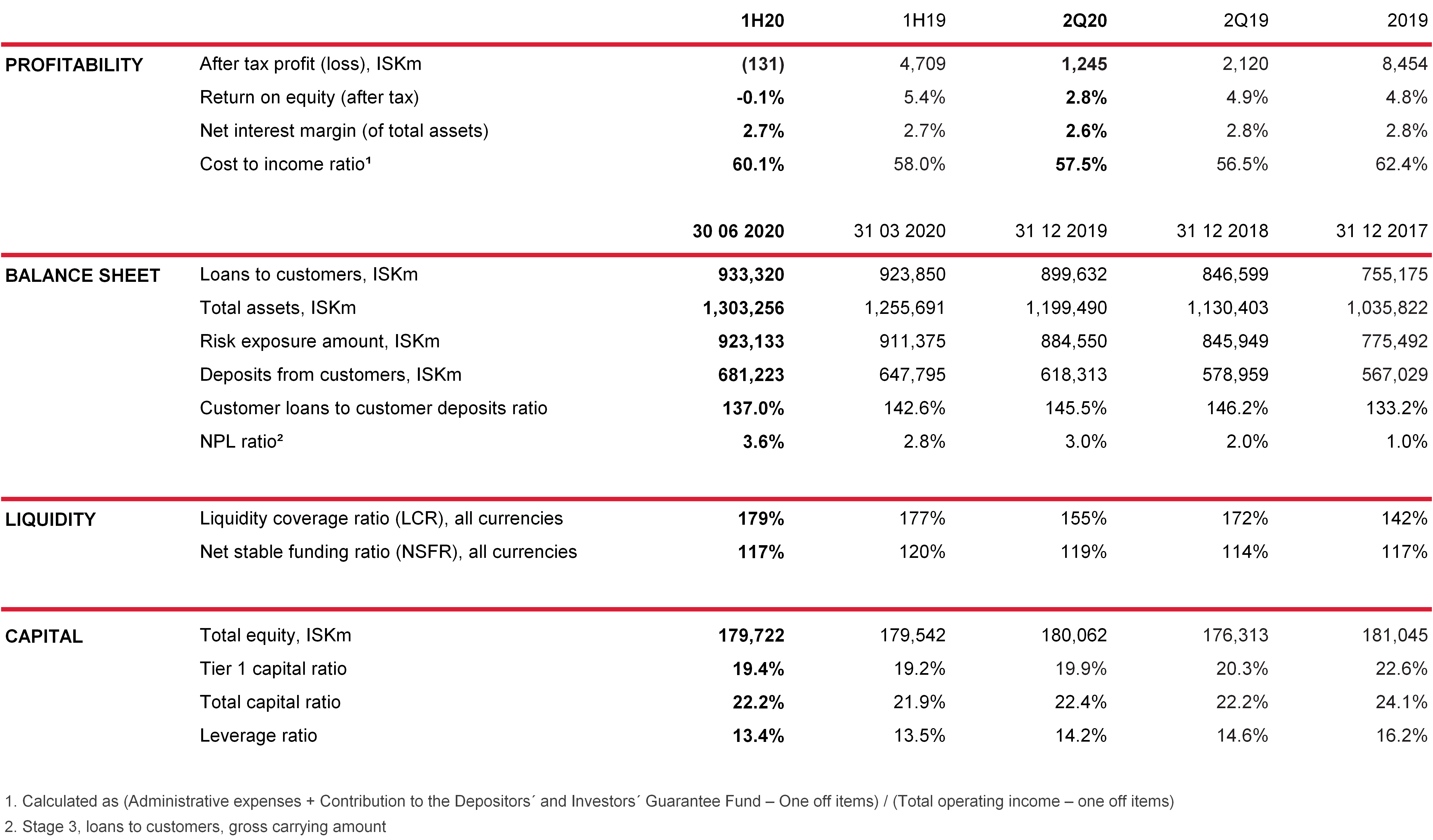

- Íslandsbanki reported a profit of ISK 1.2bn in 2Q20 compared to ISK 2.1bn in 2Q19, generating a 2.8% annualised return on equity (2Q19: 4.9%).

- NII fell by 2.1% compared to 2Q19 which is mostly explained by the Central Bank’s 200bp cut in its policy rate in late Q1 and in Q2. NFCI fell by 16.4% mostly due to reduced payment card activity. Other net operating income were ISK 98m compared to ISK 192m in 2Q19.

- Administrative expenses fell by 5.6% as a result of cost cutting initiatives in recent years.

- Impairment amounting to ISK 2.4bn in 2Q20 is to a large extent the result of a re-evaluation of the possible effects of the COVID-19 pandemic on exposures to customers in the tourism industry, classified as Stage 2.

- Loans to customers increased by ISK 9.5bn, largely driven by loans to individuals. Deposits from customers increased by ISK 33.4bn mainly due to growth in deposits from pension funds and individuals.

First half 2020 (1H20) financial highlights

- Íslandsbanki reported a net loss of ISK 131m during the first half of 2020 compared to a profit of ISK 4.7bn in 1H19. The main reason is an impairment charge amounting to ISK 5.9bn that reflects the current economic situation following COVID-19. In addition, financial loss amounted to ISK 1.9bn due to unfavourable market conditions. Annualised return on equity (after tax) was -0.1% (1H19: 5.4%).

- Net interest income (NII) increased by 2.9% compared to 1H19 and net interest margin remained stable at 2.7%. Net fee and commission income (NFCI) fell by 11.2% compared to 1H19 and is in most part explained by reduced payment card activity in the wake of COVID-19.

- Administrative expenses fell by 7.0% compared to 1H19 due to FTE reductions in 2019, modest wage increases and overall reduction in expenses.

- Loans to customers amounted to ISK 933bn at end of 1H20 and rose by 3.7% from year-end 2019. Thereof ISK 19.2bn is a result of the depreciation of the Icelandic krona. Mortgage lending increased by ISK 12.3bn and was largely driven by the lowering interest rate environment. NPL ratio was 3.6% for stage 3 loans (gross).

- Deposits from customers amounted to ISK 681bn by end of 1H20 and have increased by 10.2% from year-end 2019. The rise is largely due to increased deposits from pension funds. The strength of the Bank´s foreign currency liquidity ratios combined with limited funding requirement has meant that liability management exercises have continued to be economical for the Bank.

- Capital position is strong with total capital ratio at 22.2% by end of 1H20, CET 1 ratio at 19.4%, leverage ratio at 13.4% and sound liquidity ratios.

Key figures and ratios

Birna Einarsdóttir, CEO of Íslandsbanki

The Bank reported a profit of ISK 1.2bn in the second quarter. Impairment of financial assets, which is to a large extent the result of a re-evaluation of the possible effects of the COVID-19 pandemic, had a significant negative impact on the results. Administrative expenses decreased by 7.0% between years as cost- cutting initiatives from last year feed through into the results.

Íslandsbanki has continued to collaborate with its customers and applications for support loans now amount to over ISK 1.5bn. Many applications have already been processed and more await approval. We saw strong growth in new lending during the first six months of the year. There was strong demand for mortgages and large number of customers benefitted from financing from Ergo, the Bank´s leasing unit, which has seen its busiest spell in years. Green loans introduced earlier this summer have been exceptionally well received. Deposits from customers grew substantially during the period or by 10.2%. Strong capital and liquidity positions enable the Bank to continue collaborating with its customers.

Customer behaviour and preferences have changed since the COVID-19 pandemic started. Visits to branches have fallen and use of digital solutions continues to rise. We, for example, introduced a new chatbot “Fróði” during the period that supports retail customers with their banking services. The Bank will also benefit from home-working and has started a pilot scheme which allows employees to work from home one day per week in order to reduce travel and thereby reducing CO2 emissions.

Íslandsbanki will continue to support its customers through uncertain times, stay optimistic for the times ahead and live by our vision to be number one for service.

COVID-19 pandemic in Iceland and Íslandsbanki's actions to support customers

- Number of cases in Iceland remain are currently 28 and quarantine and tracing measures continue.

- On June 15, Icelandic borders were reopened. All travellers arriving in Iceland can choose to be tested for COVID-19 for a fee of ISK 15,000 (about EUR 100) as an alternative to a two-week quarantine.

- The Bank’s branches were reopened on 11 May. Íslandsbanki has maintained a full business continuity throughout the COVID-19 pandemic and offered service via digital solutions and phone.

- Íslandsbanki’s measures that were introduced in 1Q20 include allowing suspension of payments of principal and interest for up to six months.

- Assistance for corporates aim to incorporate and enable the solutions that the Government has put forward. Support loans and supplemental lending are key solutions and bear 70-100% state guarantee and are intended for companies that meet certain conditions.

- As of the end of 1H20, about 1,600 loans to companies amounting to almost ISK 150bn have been granted moratorium. This exposure is equivalent to approximately 26% of the corporate loan book.

- As of the end of 1H20, over 2,500 loans to individuals (including mortgages) amounting to almost ISK 30bn have been granted moratorium. This equals about 8% of the loan portfolio to individuals.

First half 2020 (1H20) operational highlights

- Íslandsbanki confirmed the sale of its 63.5% holding in Borgun hf. to Salt Pay Co Ltd. on 7 July 2020, originally announced in March. The transaction will have a limited impact on the Bank’s operations. Borgun hf. is classified as disposal group held for sale in the interim financial statements.

- With increased use of digital solutions and the introduction of new ones such as for mortgages refinancing, onboarding for securities trading, electronic signatures and chatbot Fróði for retail customers, the Bank’s Laugardalur branch now has an enhanced role in providing retail banking services to individuals. The Branches at Höfði and Grandi merged with Laugardalur branch as part of the change. Following this Íslandsbanki operates 12 branches which service its customers via a highly efficient branch network.

- Services to SMEs were merged to the Bank’s corporate banking centre in Norðurturn, the Bank’s headquarters. Companies will still be able to carry out simpler banking transactions at any branch office.

- Íslandsbanki started a pilot where employees work from home one day per week. The Bank also introduced more environmentally friendly ways of transport such as electric cars and electric scooters.

- The Bank introduced an updated macroeconomic forecast for 2020-2022 which e.g. forecasts a 9.1% contraction in GDP in 2020 and a rebound in 2021.

- Íslandsbanki signed a co-operation agreement with Payday services. Payday’s services aim to simplify accounting, payroll, and payment of taxes and levies for self-employed individuals and small businesses.

- Íslandsbanki allocated ISK 30m from the Bank’s Entrepreneur Fund which is guided by the UN SDGs the Bank has chosen to support in its policy. In total 13 projects received a grant.

- Ergo Finance Solutions now offers special terms when financing eco-friendly cars and offers loans for electric bikes and charging stations.

- Íslandsbanki continued to buy back own senior debt. In addition to the liability management exercise of SEK 350 million conducted in 1Q20, the Bank repurchased SEK 75 million of a floating rate note (FRN) maturing in February 2021 and will continue to consider further purchases of short-dated debt as opportunities arise.